We no longer keep our finances centralized in a single bank. On the other hand, since so much of our finances are handled digitally, it can be harder to keep tabs on it. (If you were lucky enough to have a computer at all!)

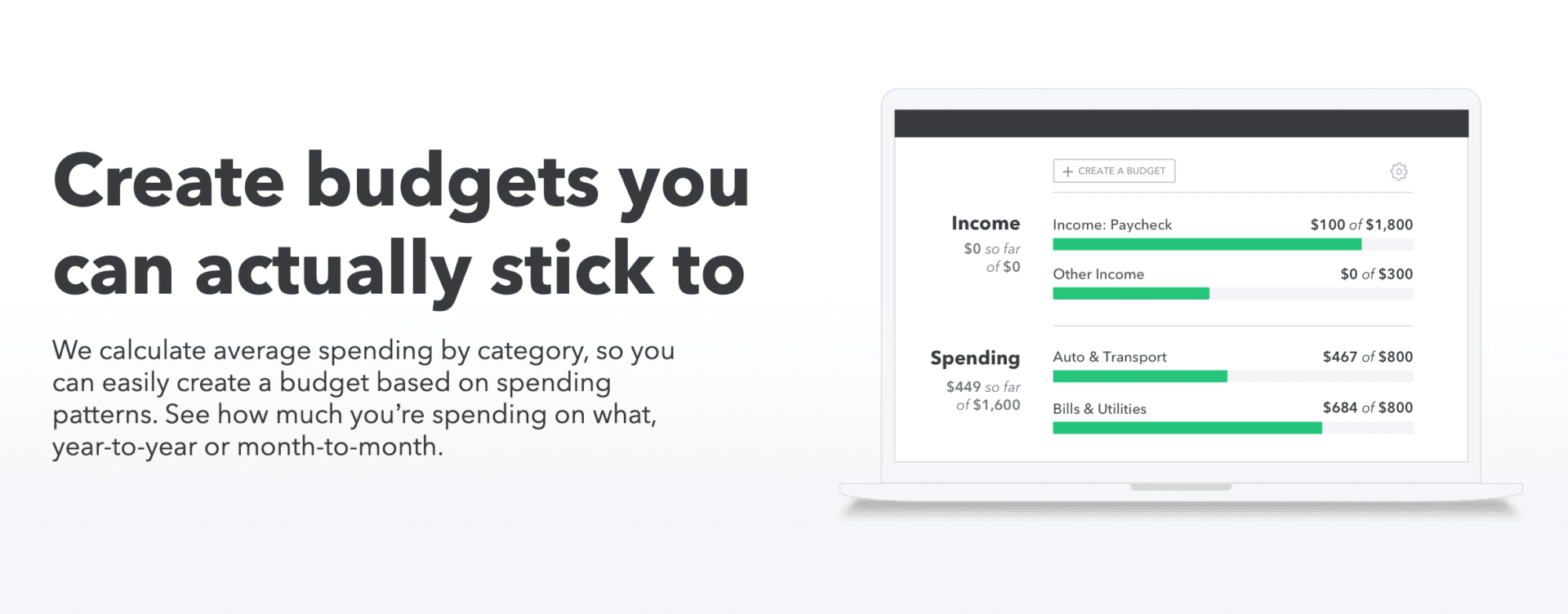

On the one hand, you no longer have to choose between tracking every penny by hand or firing up the kerosene-powered spreadsheet program to record your income and expenses. I don’t want to “hide from budgets & trends” all the time (with either categories or accounts) but that would seem to be the easiest way to do a lot of what I want above but I’m unsure if this’ll throw off tracked expenses.Keeping tabs on your finances is both easier and harder than it used to be back in the old days. If I withdraw from the LOC (categorized as loan principal), I categorize the subsequent deposit into a chequing account as a transfer, so that when I finally repay the loan (categorized as “loan payment”), only then will “loan principal” and “loan payment” net out - is this granular differentiation necessary if I want to track things correctly?īasically, I’ve got a lot of transactions that are really just transfers between accounts, and they clog up my transactions list. Transfers between accounts are under the main category of “transfers”, card payments are within the subcategory of “credit card payments”, loans are in the subcategory (under the main category “loans”) as either “loan payment” or “loan principal” if repaying or borrowing, respectively. Currently, I manually split the transaction (if not fully reimbursed), tag BOTH the portion that’s supposed to be repaid to me & the subsequent reimbursement as “reimbursable” (hidden from trends & budgets).ī) Transferring money around to pay bills, mortgages & loans.

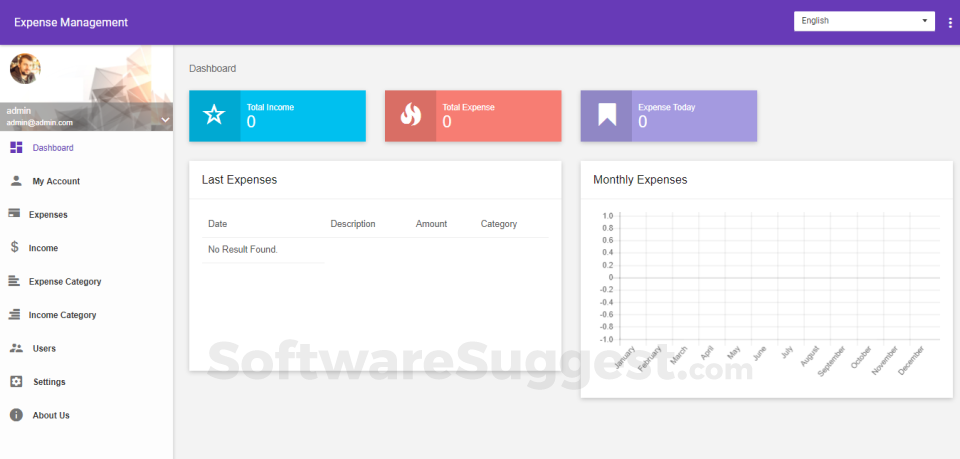

What’s the simplest, most automated way of categorizing/tagging the following transactions without messing up the overview graph, trends & budgets?Ī) Paying reimbursable expenses.

When saving transaction rules, can tags be saved along with the categorization?

0 kommentar(er)

0 kommentar(er)